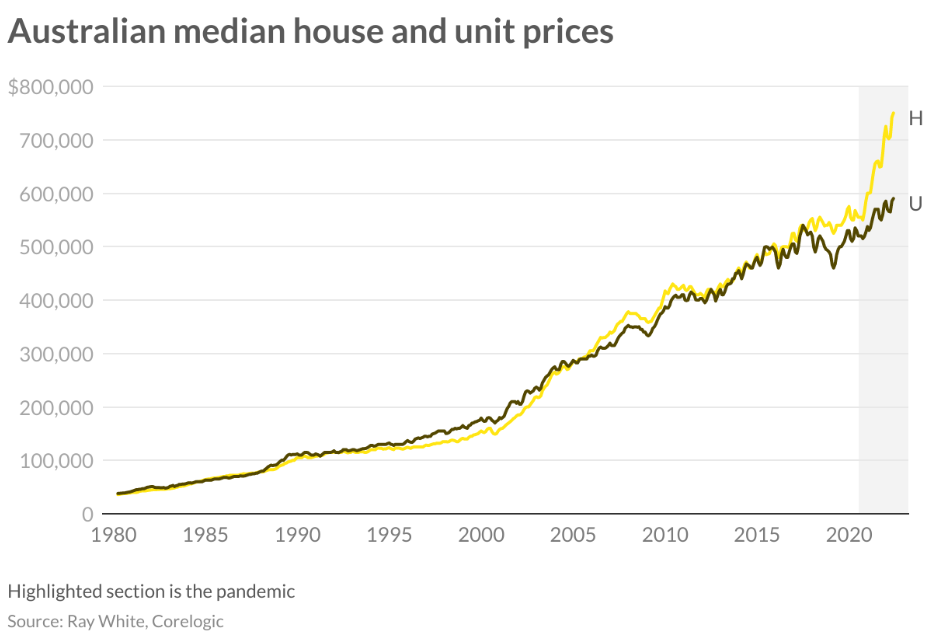

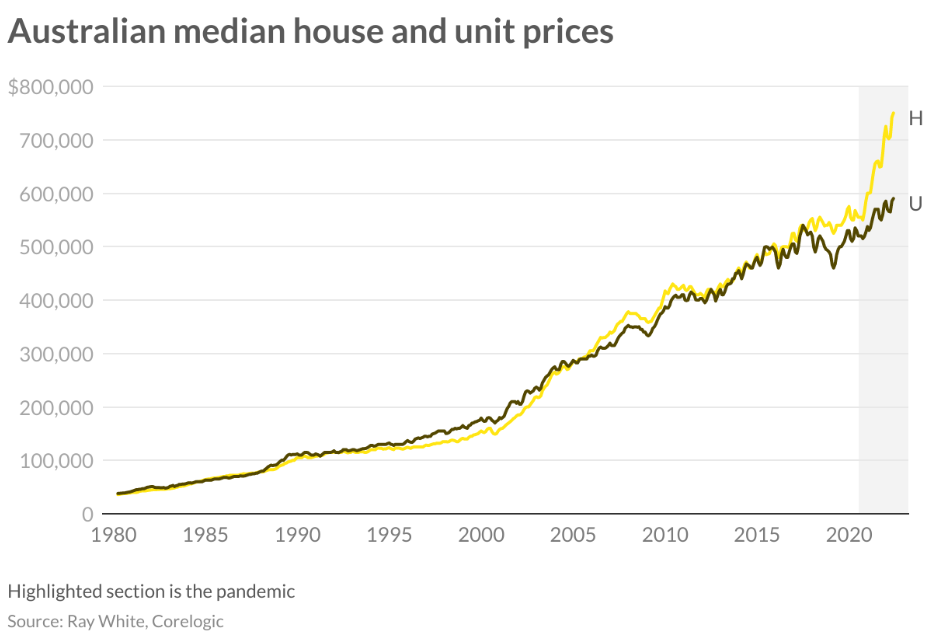

There are many ways to measure price growth, and the performance of Australian house prices are either declining or starting to see a more sustainable rate of growth depending on what method you use. Nevertheless, we’re clearly in a new cycle where the red hot market of 2021 has come to an end. Median house prices have increased by 3.4 per cent in the first five months of this year but this is a distinct slow down from the 9.8 per cent increase experienced in the final five months of 2021.

While the end of ultra low interest rates are clearly a factor driving this current slow down, it’s now timely to have a look at what drives house prices as this will determine how much of a market change we’re in for.

1. INTEREST RATES

House prices are highly correlated with interest rates at a national level. Not surprisingly, as it becomes more expensive to pay off a loan, people can borrow less. Once you move beyond aggregates, however, there are often other drivers that override this. Overall, Sydney and Melbourne are the most sensitive to interest rate changes primarily because of high debt levels. In more affordable locations, the link is a lot weaker.

2. ACCESS TO FINANCE

Restrictions to finance also slow down property markets. Right now, restrictions to finance are relatively low. In anticipation of increasing rates, the Australian Prudential Regulatory Authority (APRA) increased the interest rate buffer on mortgages last year – when lenders assess new borrowers’ ability to meet their loan repayments, they must show they can pay at an interest rate it’s at least three percentage points above the loan product rate. Similarly to interest rates, Melbourne and Sydney are far more sensitive to finance restrictions.

3. ECONOMIC GROWTH

In a strong growth economy, people are less worried about losing their jobs and when it comes to housing, their ability to pay off their loans. As a result, sentiment towards housing tends to be stronger. We’ve seen this most recently following the start of the pandemic. Although initially house prices declined, once it became apparent that the economic downturn would be short lived, prices bounced back quickly.

4. POPULATION GROWTH

More people need more housing so population growth unsurprisingly results in house price rises. The evidence on this is most striking in small regional towns when there is some form of economic stimulus. The opening of a new mine, for example, can dramatically increase house prices, similarly very strong growth in tourism can have a similar effect. With international borders reopening, population growth is set to get back to more normal levels and this will keep pressure on housing demand.

5 . HOUSING SUPPLY

If population growth is occurring but housing supply is constrained, house price growth (and rental growth) will occur due to the shortage. Although housing supply is the most direct way to ensure affordability, it’s also the most complicated. Right now, we’re in an environment of constrained housing supply due to rising construction costs and this is likely to be a key factor in keeping house prices high rising interest rates.

6. SENTIMENT TOWARDS PROPERTY

Although interest rate increases can explain the most recent slowdown in house prices, sentiment towards housing is also a factor. Last year, it was a seller’s market – prices were moving quickly and the number of people bidding at auction hit record highs. Since the start of the year, the market has firmly moved into the buyer’s favour as sentiment has turned.

7. TAXATION

Taxation can be used as both a deterrent to buying, as well as an incentive. Generally it’s used to drive certain behaviour – for example, negative gearing ensures we have enough rental housing while stamp duty reductions are used to encourage first home buyers. While it does achieve certain goals, it can often drive up (or down) prices.

8 . URBAN REGENERATION

Urban regeneration can result in significant price increases over a prolonged time period. Within large cities, this generally happens when older people move out of a suburb and young people move in their place. It can also be driven by more subtle drivers such as a renewed retail precinct or traffic calming within a neighbourhood.

9. INFRASTRUCTURE IMPROVEMENTS

Significant infrastructure spending can completely change house values in the areas that they benefit. The announcement of the Western Sydney airport and the subsequent investment that has taken place since then has led to marked changes to housing demand in the surrounding area. Similarly, continued investment in transport links between Geelong and Melbourne have led to pricing in Geelong more closely resembling Melbourne pricing.

10. GOVERNMENT POLICY

Government policy can change house prices. Easing up of planning controls can lower the cost of housing while policies that put more money in people’s hands can increase them. The main change to government policy this year will be the introduction of the shared equity scheme, allowing low income earners to buy a home in partnership with the government. It’s expected that this will lead to higher prices, particularly at lower price points.

11. CONSTRUCTION COSTS

It’s getting more expensive to build a home. This will push some people into established housing (if building becomes too expensive for them) and will lead to a shortage of housing (projects will be put on hold). Fewer new homes and more people wanting existing homes will mean that prices won’t fall as much as they otherwise would.

12. PERFORMANCE OF OTHER INVESTMENT TYPES

Most people that purchased property during the pandemic have done particularly well in terms of capital growth. Although this is now slowing, strong rental growth is now occurring and many investors will benefit from this. An investor sell-off of property assumes either a focus on reducing debt or a wish to invest in something else. While property price growth is slowing, so too is the rate of growth of other asset classes. In some cases, prices are falling rapidly (e.g., technology stocks and Bitcoin). Property is often called “inflation proof” and while that’s not always the case given its sensitivity to interest rate rises, the stability of rental returns can often offset changes in value.

If you’re looking to sell and would like an expert opinion on the present value of your property, please get in touch.