We’re delighted to introduce the first Ray White Luxury Report, providing unparalleled insights into Australia’s high-end residential property market. As the nation’s leading real estate group, Ray White has an unmatched depth of data and expertise when it comes to luxury home sales.

This inaugural report leverages Ray White’s extensive data on property transactions across the country to offer a comprehensive overview of the luxury market. The report examines key trends and market performance in Australia’s most sought-after locations.

Ray White’s unique position in the market is a key strength of this report. As the agency that sells one in six homes priced above $5 million nationwide, we have an intimate understanding of the luxury property landscape. Our extensive national footprint and deep client relationships allow us to identify emerging trends and analyze market shifts with a level of granularity that is simply unmatched, as well as build our database of buyers in a higher price bracket.

Whether you’re a high-net-worth investor, a luxury homeowner, or simply have a keen interest in Australia’s premium real estate, the Ray White Luxury Report is an essential resource. Through incisive data analysis and expert commentary, this report offers a revealing window into the world of luxury property – providing the knowledge and insights you need to make informed decisions in this dynamic market.

Nerida Conisbee,

Chief Economist

E X E C U T I V E S U M M A R Y

Australia’s luxury home market is in a unique position. With a growing wealthy population and historically high price volatility, the timing of luxury home purchases has never been more important. Currently, the market is experiencing an unprecedented surge in prices for prime and super-prime properties, largely driven by limited supply, as there are only so many properties that can be built in the most desirable locations near beaches, bays, and rivers. Homes with unique characteristics, such as exceptional views or proximity to water, are seeing even greater price appreciation.

The Australian luxury home market demonstrated strong long-term growth trends over the past decade (2014 to 2023) with luxury house prices outpacing median prices at 84 per cent compared to 70 per cent and luxury unit prices outpacing median prices at 58 per cent compared to 31 per cent. Notably, Hobart led with a remarkable 122 per cent growth in luxury house prices and a 101 per cent growth in luxury unit prices. 2023 was a unique year though because for the first time in the past decade, median prices grew stronger than luxury prices.

In terms of transaction volume, the luxury home market experienced some notable shifts over the past decade. Melbourne dropped four per cent market share in luxury units and 12 per cent market share in luxury houses, while the Gold Coast emerged as a rapidly growing luxury unit market with a nine per cent increase in market share. Brisbane experienced substantial growth too with both luxury house and luxury unit prices surpassing the million-dollar threshold for the first time. Its luxury transaction growth rate in 2023 was the largest of any major city. Meanwhile, Sydney continues to dominate, accounting for 64 per cent of all luxury house sales nationally and 51 per cent of all luxury unit sales.

Overall, while 2023 saw stronger growth in median prices, the luxury market remains robust, particularly over a 10-year horizon. Regional disparities in growth rates and transaction volumes reflect varying market dynamics across Australian cities.

N A T I O N A L

PRICES

When comparing 2023 with 2014, luxury house prices increased by 84 per cent while median house prices grew by only 70 per cent. Hobart leads the growth rate race with 122 per cent across the last 10 years, while Brisbane follows close behind with 102 per cent growth.

Melbourne was the only major city where median house price growth exceeded luxury house price growth. Meanwhile, Perth showed the largest gap between growth rates with a 24.3 per cent gap between luxury and median house price growth rate. Sydney had the second largest gap at 21.8 per cent difference between luxury and median house price growth rates.

Likewise, luxury unit prices outpaced median unit prices by growing 58.3 per cent vs the latter’s 31.5 per cent. Hobart had the largest growth rate across major cities with 101 per cent for luxury and 102 per cent for median; it also happens to be the only city where median unit price growth was greater than luxury unit price growth.

Sydney is another standout as it not only has the second largest luxury unit price growth, but it also has the most expensive luxury unit prices, the largest difference between luxury and median price growth, and the largest difference between absolute luxury and median prices.

Overall, 2023 was a stronger year for median prices, but with an expanded time horizon of 10 years, luxury prices are the more bullish of the two.

For the first time in Australia in the past decade, luxury price growth in both houses and units was smaller than median price growth. Luxury house prices increased by 6.2 per cent while median property prices increased by 7.7 per cent. The discrepancy in luxury units wasn’t as wide but median price growth was still greater at 5.7 per cent compared with luxury price growth at 5.5 per cent.

PRICE GROWTH FROM 2022 TO 2024 – HOUSE VS UNIT

SALES AND MARKET SHARE

2019 to 2022 was a very strong period for both the luxury house and luxury unit market with sales growing by 1.8 times and 1.5 times, respectively. In the face of this, the luxury house market corrected itself with a 10 per cent drop in sales for 2023, while the luxury unit market corrected itself with an eight per cent decline.

COUNT OF LUXURY TRANSACTIONS – HOUSE VS UNIT

In terms of distribution, Sydney has dominated the luxury house market with 64 per cent of all transactions taking place within the harbour city. This is up by 13 per cent from 2014. Melbourne, which comes in second, with a loss of four per cent of its share to end 2023 with only 19 per cent of all luxury house sales. No other city comes close to attracting the demand that Sydney (or even Melbourne) commands. Perth even saw a seven per cent drop in share from nine per cent in 2014.

Although Sydney grew two per cent to end 2023 with a 51 per cent share of all luxury unit transactions, the spotlight must be turned to the drama between Gold Coast and Melbourne. While Melbourne’s share more than halved in value, the Gold Coast showed a nine per cent share growth between 2014 and 2023.

COUNT OF TRANSACTIONS AS PER CENT OF TOTAL LUXURY HOUSE TRANSACTIONS

TOP SUBURBS

It should come as no surprise then that Sydney dominates the top 10 suburbs for luxury house sales in 2023. Mosman comes first with 145 sales; a figure double that of runner-up Vaucluse. Toorak, Brighton and Kew are the only suburbs on the list outside of Sydney.

TOP SUBURBS FOR LUXURY HOUSE S ALES (2023)

Count of house sales over $5M

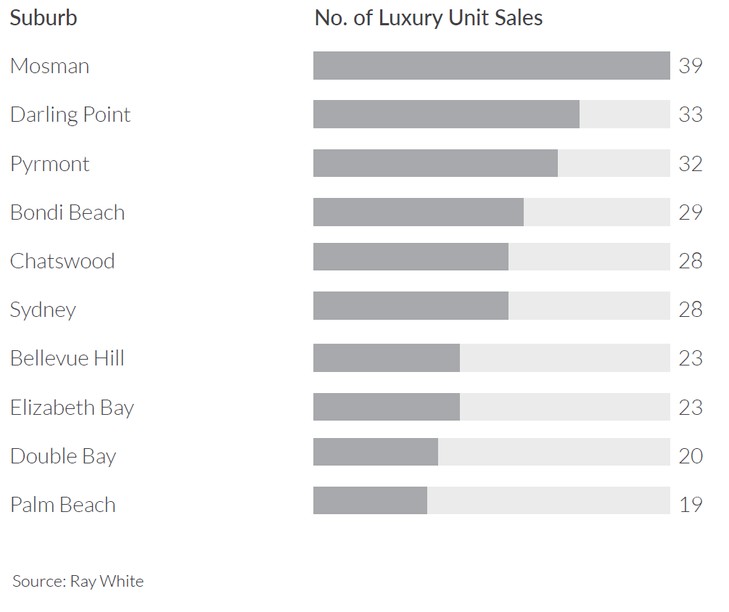

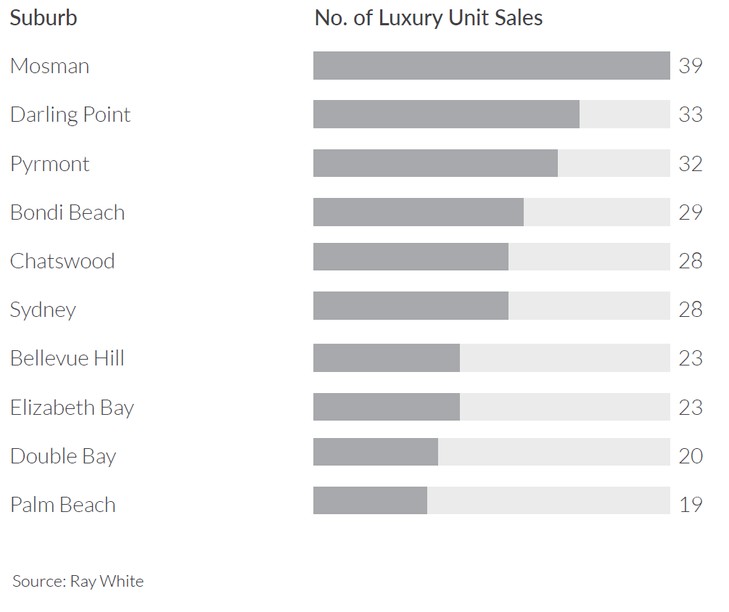

Unlike with luxury houses, the top sales for luxury units are not as concentrated in one suburb, but it is still dominated by Sydney. Manly in Sydney was the suburb with the most luxury unit sales in 2023 followed closely by Mosman, Darling Point, and Pyrmont. Toorak (Melbourne) is the only suburb not in Sydney that appears in the top 10.

TOP SUBURBS FOR LUXURY UNIT SALES (2023)

Count of unit sales over $3M

S Y D N EY

In 2023, Sydney luxury home prices sat at $3.9 million, 93.3 per cent greater than it was in 2014. During the same period, median prices grew by only 71.6 per cent to create the largest price growth gap among major cities. With a median price at $1.4 million, Sydney also has the largest luxury to median house price ratio among major cities.

HOUSE PRICES PER YEAR – MEDIAN VS LUXURY

Trends in the house market are only magnified in the unit market. Here, Sydney showed an even larger difference not only in price growth, but also in absolute prices. In 2023, luxury unit prices were recorded at $2.1 million (+72.2 per cent vs 2014) while median unit prices were recorded at only $794,000 (+25.4 per cent vs 2014).

UNIT PRICES PER YEAR – MEDIAN VS LUXURY

Zooming into 2023, this was the first year that Sydney’s median house prices grew greater than luxury house prices. Luxury house prices increased by 5.9 per cent from 2022 while median prices increased by 6.7 per cent. No trend changes were seen in unit market prices with luxury unit price growth at 5.4 per cent and median unit price growth at only 4.2 per cent.

PERCENT PRICE GROWTH FROM 2022 TO 2023 – HOUSE VS UNIT

Despite such a dramatic increase in prices, Sydney is selling seven times more luxury houses and units now than it was 10 years ago. In 2023, Sydney sold 1,782 luxury houses and 683 luxury units. Although this is very high, relative to the past 10 years, luxury house transactions still dropped by four per cent from 2022, while luxury unit transactions dropped by two per cent. The shape of the trend is similar to that seen in national sales volume, but the drop between 2022 and 2023 was not as steep.

SYDNEY MIRRORS THE TRENDS FOUND IN NATIONAL; LUXURY EASED IN 2023

Mosman is Sydney’s top suburb for luxury houses with a significant gap from the runner-up suburb, Vaucluse. The distribution of luxury unit sales, on the other hand, is more evenly spread out. Still, Mosman comes out on top, followed by Darling Point.

SYDNEY’S TOP SUBURBS FOR LUXURY HOUSE SALES (2023)

Count of house sales over $5M

SYDNEY’S TOP SUBURBS FOR LUXURY UNIT SALES (2023)

Count of unit sales over $3M

TO READ THE FULL REPORT AND THE REST OF THE CAPITAL CITIES,

CLICK HERE:

If you would like any assistance or advice from our team at Ray White Lower North Shore Group, please get in touch below.

If you would like any assistance or advice from our team at Ray White Lower North Shore Group, please get in touch below.